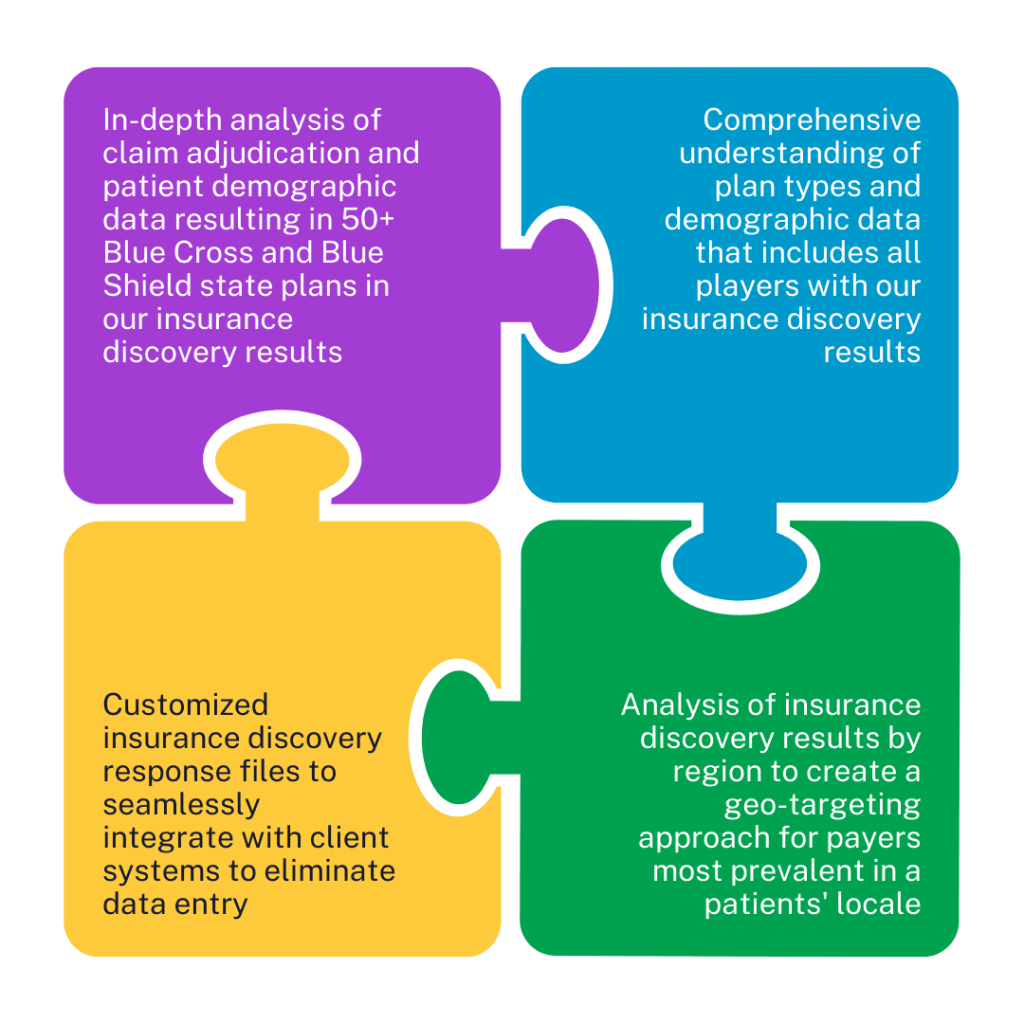

SOLVING THE INSURANCE DISCOVERY PUZZLE WITH OUR UNIQUE APPROACH

Utilizing 50 Blue Plans

Locate active coverage with commercial and government payers

Our geo-targeted approach to uncovering active coverage from self-pay accounts accelerates revenue while eliminating costly outreach to patients

We apply unique mapping logic with government, commercial and managed care payers while achieving success rates between 20% - 50% in locating active coverage

DISCOVER THE INTEGREX HEALTH DIFFERENCE

Features

- Efficiently and economically convert self-pay accounts to active coverage

- Optimize patient admission and registration process

- Streamline patient outreach by avoiding unnecessary statements

- Actionable data returned includes effective coverage dates and remaining deductible, co-payment and co-insurance amounts

Benefits

- Reduce denials up to 20%

- Shorten the billing cycle with accurate submissions

- Increase upfront collections at the point of care

CASE STUDIES

For 13,156 Medi-Cal accounts, we identified active coverage for 10,959 rows, corrected 2,915 names and dates of birth, resolved 617 incorrect member IDs, and uncovered Managed Care Organizations or IPAs for 8,397 rows.

An RCM firm serving hospitals and clinics achieved a 30% success rate in locating active coverage, a 2.5X ROI, and improved resource efficiency by implementing a daily insurance validation process and customizing output files for claim submissions.

A radiology firm achieved a 33% success rate in locating active coverage, a 3X return on spend, and faster revenue cycles by automating claim submissions, prioritizing payers, and streamlining Blue plan validation through weekly insurance verification.